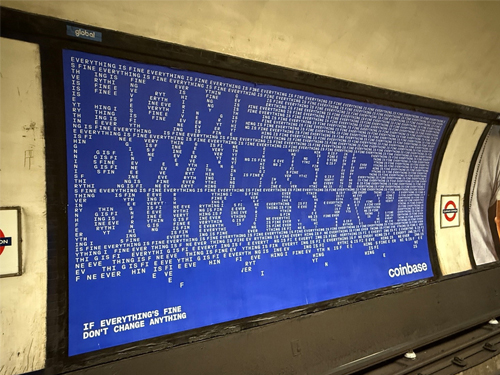

A bold new poster campaign by Coinbase has appeared across London, declaring “HOME OWNERSHIP OUT OF REACH” against a backdrop of “EVERYTHING IS FINE”. The ad ends with the line “IF EVERYTHING’S FINE DON’T CHANGE ANYTHING” and features the Coinbase logo. The implication? That crypto might be the answer to the housing crisis.

But is this messaging compliant with the UK’s advertising rules?

Before turning to the ASA’s perspective, it is worth noting that the Financial Conduct Authority (FCA) now regulates the promotion of qualifying cryptoassets. However, the ASA retains jurisdiction over the presentation, tone, and content of non-broadcast crypto advertising - particularly where consumer protection is at stake.

1. The ASA Rules in Play

The advert appears to fall within the scope of the CAP Code, which applies to posters and other promotional media in public places.

Several provisions are potentially engaged:

1.Misleading Advertising (Section 3)

- Rule 3.1: “Marketing communications must not materially mislead or be likely to do so.”

- Rule 3.3: “Marketing communications must not omit material information or information required to be included by law.”

2. Harm and Offence (Section 4)

- Rule 4.2: “Marketing communications must not cause fear or distress without justifiable reason.”

3. Compliance (Section 1)

- Rule 1.3: “Marketing communications must be prepared with a sense of responsibility to consumers and to society.”

4. Financial Products (Section 14)

- Rule 14.1: “Offers of financial products must be set out in a way that allows them to be understood easily by the audience being addressed.”

2. What Are the Issues?

(1) Implied Financial Return

The ad appears to suggest that investing in crypto could be a viable route to home ownership. While the messaging is indirect, the juxtaposition of housing unaffordability with the Coinbase brand strongly implies that crypto investment is a solution. This could be interpreted as suggesting that crypto will increase in value - potentially enough to buy a house. That is a bold implication, and one that is likely to be difficult (if not impossible) to substantiate.

(2) Omission of Risk Warnings

There is no mention of the risks associated with cryptoassets. This is a significant omission. The ASA has consistently ruled that crypto ads must include clear and prominent warnings about volatility, lack of regulation, and the risk of losing all invested capital. The absence of such warnings may breach Rule 3.3.

(3) Emotional Leverage

The ad plays on a real and emotive issue - housing unaffordability. By framing crypto as a response to this crisis, the ad may be seen as exploiting consumer anxiety, potentially engaging Rule 4.2.

(4) Lack of Clarity

The ad does not explain what Coinbase offers or how it relates to the housing market. This lack of clarity may fall foul of Rule 14.1, which requires financial promotions to be easily understood.

3. Deep Dive: The Illusion of Certainty

Perhaps the most concerning aspect of the advert is the impression it gives that crypto is a reliable - or even inevitable - route to wealth. The messaging does not merely suggest that crypto is an alternative investment; it implies that it is a solution to a systemic economic problem. In doing so, it risks misleading consumers into believing that crypto investment is a path to financial security.

Under the CAP Code, “Marketing communications must not materially mislead or be likely to do so” (Rule 3.1), and “must not omit material information or information required to be included by law” (Rule 3.3). These provisions are particularly relevant where an ad implies a financial benefit but fails to mention the associated risks.

The Coinbase ad includes no warning that cryptoassets are volatile, unregulated, or that consumers could lose their entire investment. It presents crypto not as a high-risk, speculative asset class, but as a potential solution to one of the UK’s most pressing social issues. That is a significant compliance risk.

4. Comment: A Familiar Pattern

This is not the first time crypto advertising has tested the boundaries of the CAP Code. The ASA has previously banned ads by Crypto.com, Luno, and Arsenal FC for similar issues - particularly around misleading implications and lack of risk disclosure.

The Coinbase ad may be part of a wider trend of “soft” crypto promotion - using social commentary to imply financial solutions. But the ASA has made clear that even indirect messaging must comply with the rules.

5. Takeaway for Advertisers

If you are marketing cryptoassets - or any financial product - keep these tips in mind:

- Include clear and prominent risk warnings.

- Avoid implying guaranteed or likely financial benefits.

- Do not exploit consumer anxieties or social issues.

- Ensure your messaging is clear, substantiated, and responsible.

Whether the ASA takes a closer look at this campaign is something we will be keeping an eye on.

PS: Thank you very much to my colleague, Rosie Burbidge, for sharing this interesting ad with me!

/Passle/65522ff14b6c7bf686eea41e/SearchServiceImages/2026-01-07-15-44-58-064-695e7f7a3f58571375d1f0b8.jpg)

/Passle/65522ff14b6c7bf686eea41e/SearchServiceImages/2025-11-05-12-58-35-235-690b49fb331a31629324946f.jpg)